Conformidade regulatória simplificada

Simplifique a autorização VASP e mantenha a conformidade com as regulamentações do Banco Central do Brasil. Clav centraliza toda a sua estrutura de conformidade em uma plataforma.

Tudo que você precisa para ter sucesso em compliance

Gerencie requisitos regulatórios, rastreie evidências e mantenha uma postura de conformidade com nossa plataforma abrangente.

Gerenciamento de Estrutura

Acompanhe diversas estruturas de conformidade simultaneamente com monitoramento do progresso em tempo real e categorização detalhada de requisitos.

Rastreamento de controle

Gerencie mais de 419 controles de conformidade com rastreamento automatizado de atribuições, monitoramento de status e validação de evidências.

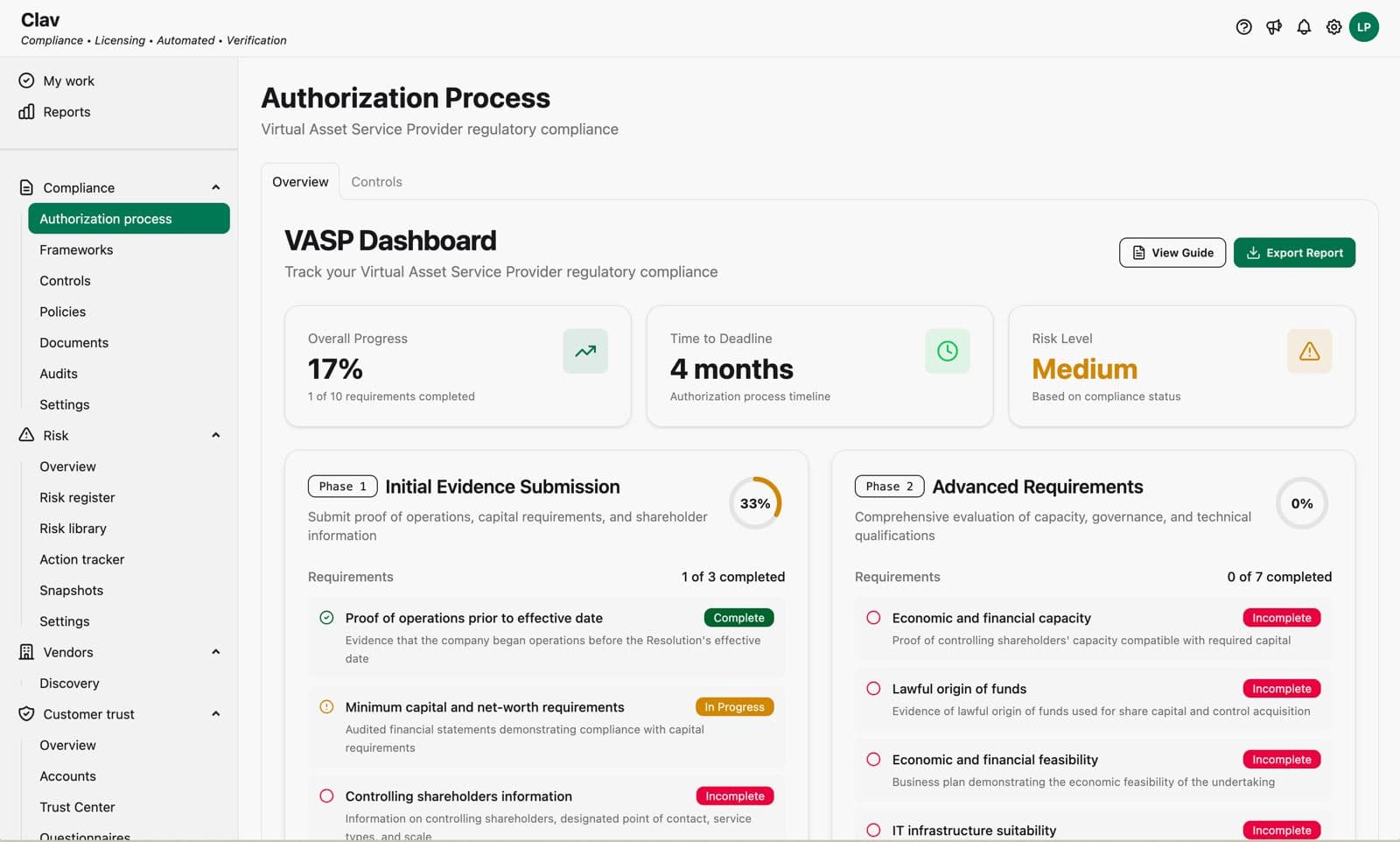

Autorização VASP (BACEN)

Cumpra o processo de autorização de Fase 1 e Fase 2 do Banco Central do Brasil por meio de gerenciamento estruturado de evidências e automação do fluxo de trabalho de aprovação.

Gerenciamento de Políticas

Acesse políticas de conformidade pré-configuradas com controle de versão, biblioteca de modelos e gerenciamento de ciclo de vida.

Evidências e Documentação

Carregue e gerencie evidências de conformidade com rastreamento de status automatizado e trilha de auditoria completa.

Teste de conformidade

Integre testes automatizados e verificações manuais com rastreamento de aprovação/reprovação em tempo real e monitoramento de atrasos.

Conteúdo e frameworks jurídicos da Clav produzidos por Paiva Gomes Advogados

Cronograma de conformidade e autorização

Fluxo completo e detalhado de obrigações regulatórias do Banco Central do Brasil para prestadores de serviços de ativos virtuais.

02/02/2026ENTRADA EM VIGOR

Marco zero para a eficácia das Resoluções BCB 519 e 520/2025

Detalhes e obrigações completos

- VASP deve estar ‘em operação’ nesta data

- Início da contagem regressiva do período de conformidade de 270 dias

- Prazo final: 29/10/2026

02/02/26 até Decisão do BCBPERÍODO DE CONFORMIDADE

270 dias para solicitar e estar em conformidade + prazo de conformidade se estende até a decisão do BCB na FASE 1

Detalhes e obrigações completos

- Duração: 270 dias para arquivar e estar em conformidade

- Prazo de compliance se estende até decisão do BCB sobre Fase 1

- Observar o art. 88 (Res. 520)

- PROIBIDO assumir nova modalidade

PERÍODO PROTEGIDO

Durante este período é PROIBIDO assumir novas modalidades de atendimento. Use esse tempo para estruturar todas as políticas, processos e evidências documentais necessárias.

Até 29/10/2026MOMENTO DE ARQUIVO

Prazo para protocolar pedido de autorização no BCB

Detalhes e obrigações completos

- Solicitação de autorização:

- • Solicitação de arquivo junto ao BCB

- • Indicar modalidade: Intermediário, Custodiante ou Corretora

- • Observação: o descumprimento deste prazo exige a cessação das operações em 30 dias

- Evidência de Conformidade (Prova de Conformidade):

- 1. Estrutura de Gestão de Riscos:

- • Risco de Mercado

- • Risco de Crédito

- • Risco Operacional

- • Risco de Liquidez

- 2. Política de cibersegurança:

- • Política documentada

- • Plano de Resposta a Incidentes

- 3. Controles Internos e LBC/CFT:

- • Prevenção contra lavagem de dinheiro

- • Conformidade com a Lei 13.810

- 4. Regulamento Contábil:

- • Conformidade com Cosif

- • Estrutura de Auditoria

- Informações de DADOS (detalhes no próximo evento)

PRAZO CRÍTICO

O não cumprimento deste prazo implica a cessação obrigatória das atividades no prazo de 30 dias. Este é o prazo final para protocolar no BCB.

Do arquivamento até o final da fase 1RELATÓRIOS - ENVIO RECORRENTE DE DADOS

Obrigações de reporte de dados ao BCB ao longo da Fase 1 (regulamentação pendente de publicação sobre como será feito o reporte)

Detalhes e obrigações completos

- [DIÁRIO] Saldos e Custódia:

- • Saldos contábeis de clientes

- • Posição de custódia própria

- • Posição de custódia de terceiros

- [MENSAL] Provas e Staking:

- • Comprovante de Reservas (PoR)

- • Relatório de Ativos de Piquetagem

- [GERAL] Cadastro e Dados Complementares:

- • Envio de informações ao CCS (Cadastro de Clientes do Sistema Financeiro Nacional)

- • Outras informações complementares solicitadas

REQUISITOS DE RELATÓRIOS

Mantenha relatórios precisos e oportunos durante todo o processo da Fase 1 para garantir a conformidade.

Após arquivarINÍCIO DO PROCESSO DE AUTORIZAÇÃO (BCB)

Banco Central inicia análise formal do pedido

Detalhes e obrigações completos

- Análise dividida em duas fases

- Fase 1: Lista de Verificação e Reputação

- Fase 2: Capacidade e Negócios

Pós-arquivamentoFASE 1

A análise inicial focou na conformidade básica e adequação

Detalhes e obrigações completos

- O BCB analisa os seguintes critérios:

- 1. Prova de Atividade:

- • Comprovante de estar ativo em 02/02/2026

- • Evidência operacional da data do marco

- 2. Reputação Imaculada dos Controladores/Administradores:

- • Análise de antecedentes criminais

- • Verificação de processos judiciais

- • História no Sistema Financeiro Nacional (SFN)

- • Consultas e processos administrativos

- 3. Capital Mínimo e Patrimônio Líquido:

- • Verificação de capital social

- • Prova de patrimônio líquido adequado

- 4. Diretores (mínimo 3):

- 4.1 Tipos de administradores responsáveis por:

- a) conduzir as atividades e negócios desenvolvidos pela instituição;

- b) prevenir e combater o branqueamento de capitais e o financiamento do terrorismo e a proliferação de armas de destruição maciça;

- c) os sistemas de controle interno da instituição e o cumprimento da regulamentação vigente;

- d) a estrutura de gerenciamento de riscos, gestão de capital e política de divulgação de informações da instituição;

- e) segregação de ativos

- f) serviços relevantes

- h) responsável pela contratação de entidade estabelecida no exterior para custódia

- ❗ É permitida a designação de um mesmo diretor para as responsabilidades acima mencionadas, exceto em casos de incompatibilidade, conflito de interesses ou casos não permitidos por normas legais e regulamentares.

ANÁLISE EM ANDAMENTO

O BCB está conduzindo uma revisão detalhada. Certifique-se de que toda a documentação esteja completa e acessível para revisão regulatória.

Decisão do BCBFIM DO PERÍODO DE CONFORMIDADE

MARCO CRÍTICO - A partir daqui: Conformidade TOTAL

Detalhes e obrigações completos

- Da decisão do BCB sobre a Fase 1:

- • O 'período de carência' termina

- • Conformidade TOTAL (Lei 14.478 e Res. 519/520/521)

- • Mesmo sem a licença final da Fase 2, todas as obrigações devem ser cumpridas

MARCO REGULATÓRIO CRÍTICO

Após a decisão da Fase 1, o período de conformidade termina. A partir deste momento, a entidade deverá operar em total conformidade com a Lei 14.478 e as Resoluções 519/520/521.

Pós-Fase 1FASE 2

Análise aprofundada de viabilidade, estrutura e governança

Detalhes e obrigações completos

- O BCB realiza análises aprofundadas em 5 pilares:

- 1. Capacidade Econômico-Financeira e Origem dos Recursos:

- • Capacidade financeira dos controladores

- • Origem legal dos recursos (UBO Due Diligence)

- • Rastreabilidade da cadeia de investimento

- • Análise patrimonial de sócios

- 2. Viabilidade da Empresa e da Governança Corporativa:

- • Plano de negócios sustentável

- • Projeções financeiras realistas

- • Estrutura de governança adequada

- 3. Infraestrutura de TI compatível com riscos:

- • Sistemas tecnológicos robustos

- • Segurança da informação

- • Plano de contingência e continuidade

- 4. Conhecimento Empresarial pela Gestão:

- • Experiência comprovada no setor

- • Treinamento técnico em ativos virtuais

- • Conhecimento regulatório e operacional

- 5. Endereço Físico e Infraestrutura:

- • Endereço físico próprio (coworking/compartilhado proibido)

ANÁLISE EM ANDAMENTO

O BCB está conduzindo uma revisão detalhada. Certifique-se de que toda a documentação esteja completa e acessível para revisão regulatória.

FinalANÁLISE DO BCB SOBRE AUTORIZAÇÃO

A decisão final do Banco Central

Detalhes e obrigações completos

- Publicação no Diário Oficial

- Autorização para pleno funcionamento

- Início das operações regulares sob supervisão contínua

Como funciona a Clav

Configure suas estruturas

Selecione e configure as estruturas de conformidade relevantes para suas operações VASP.

Atribuir controles

Distribua controles de conformidade aos membros da equipe e acompanhe as tarefas em tempo real.

Carregar evidências

Envie documentos, resultados de testes e outras evidências para demonstrar conformidade.

Monitore o progresso

Acompanhe as taxas de conclusão, revise os status e mantenha uma postura de conformidade pronta para auditoria.

Por que escolher a Clav?

Acelere a autorização

Reduza a complexidade da conformidade regulatória da VASP com fluxos de trabalho estruturados e acompanhamento automatizado do progresso.

Nunca perca um requisito

A Clav permanece automaticamente alinhada com as atualizações regulatórias brasileiras mais recentes, garantindo que sua estrutura de conformidade evolua à medida que novos requisitos são lançados.

Colaboração em equipe

Permita a colaboração perfeita entre responsáveis pela conformidade, gerentes de risco e equipes de documentação.

Relatórios prontos para auditoria

Gere relatórios de conformidade abrangentes com trilhas de auditoria completas e documentação de evidências.

Documentação Técnica

Explore nossa documentação técnica detalhada para entender como lidamos com segurança, conformidade e gerenciamento de dados

Arquitetura de Upload de Arquivos

Saiba como protegemos seus arquivos com segurança de nível empresarial e criptografia zero knowledge opcional

Política de retenção de arquivos

Entenda como gerenciamos seus arquivos, mantemos o histórico de versões e garantimos a conformidade com os requisitos de retenção

Transparência em primeiro lugar

Acreditamos na transparência. Nossa documentação técnica está disponível publicamente para que você possa entender exatamente como protegemos seus dados e mantemos a conformidade.

Pronto para simplificar sua jornada de conformidade?

Junte-se aos principais VASPs que confiam na Clav para seu gerenciamento de conformidade regulatória. Seja um dos primeiros a experimentar o futuro da conformidade.